Invest for your future: The Crucial Benefits of Early and Consistent Investing

Balancing Cash Reserves and Investments: Why Strategic Investing Beats Hoarding Cash

We've been taught to save for a rainy day, which is wise to some extent. However, keeping all your money in cash over the medium to long term carries risks, too. In fact, doing nothing with your money is the biggest risk of all, as inflation will erode its value over time.

The amount of cash to hold as an emergency fund depends on individual circumstances. Generally, we recommend holding 3 to 12 months’ worth of living expenses. Any more can drag down your overall investment performance. For instance, a couple with two independent income sources, each capable of sustaining household expenses, plus having various protections like life and income insurance, might comfortably hold 3 months’ worth of expenses in cash. On the other hand, a single person with dependents, only one income, no protection plan, and no capacity for short-term lifestyle adjustments, might need 12 to 18 months’ worth of expenses.

Regardless of the risk profile you adopt, committing to regular investments will reap substantial future benefits, thanks to the power of compounding. People should treat regular investing for retirement like paying a mortgage. Under normal circumstances, missing a mortgage payment isn't an option, and the same mindset should apply to investments. It’s easy to reduce or pause monthly investments for temptations like holidays or new cars, simply because it is convenient to do so, but that isn’t an option with your lender, so why should it be a reason to stop investing for your future?

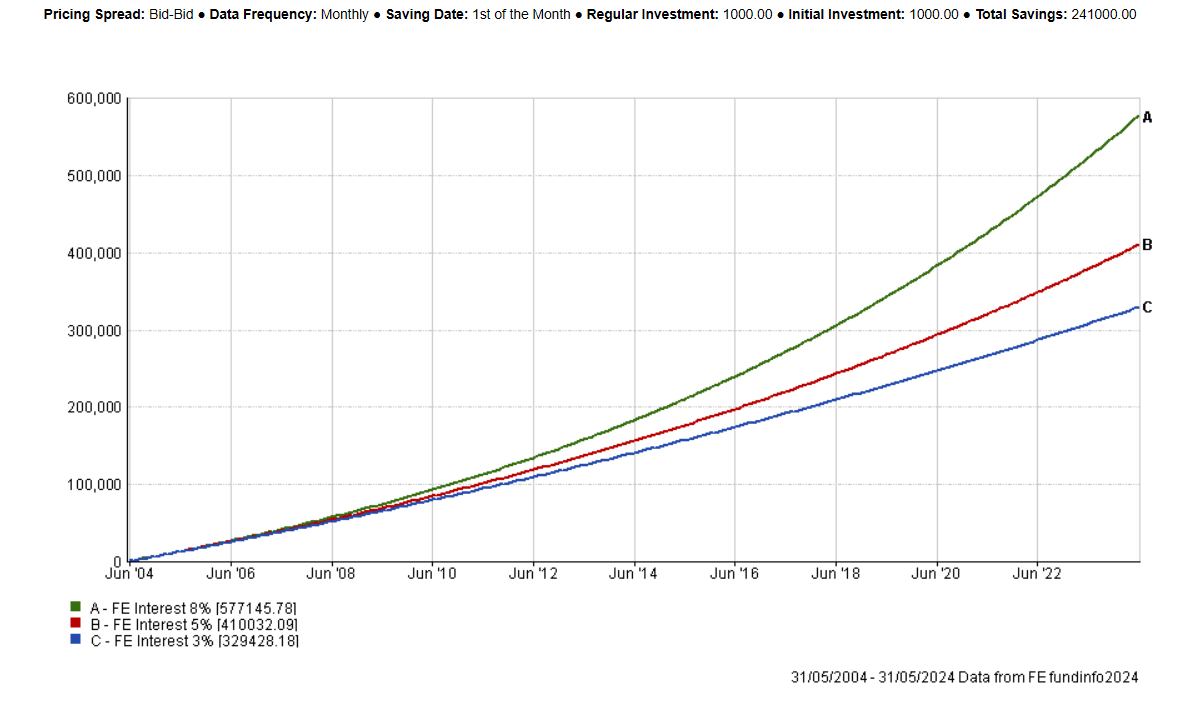

Here’s an illustrative example: an individual invests £1,000.00 a month for 20 years. With a total investment of £241,000.00 (the monthly £1,000.00 remains fixed despite inflation reducing its real value over time), the final value of the investment, at assumed 3%, 5% & 8% returns are significantly higher than the original investment amount due to compounded growth. For example, an 8% return will produce a lump sum of £577,145.78, representing a growth of £366,145.78.

This chart demonstrates the power of building wealth steadily and deliberately. Although not everyone has a 20-year investment plan, we often encounter individuals who still set aside excessive amounts of cash for a rainy day. Statistically, the need for such large reserves is limited. It’s a difficult topic, but it’s crucial to address the pitfalls of holding too much cash vs. the benefits of investing wisely and making sure you stick to it.

Risk Warnings:

The information contained in this article is intended solely for information purposes only and does not constitute advice. The price of investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested. Past performance is not necessarily a guide to future performance.

The Iron Wealth Blog