Redundancy - A Blessing In Disguise?

Time to devise a Plan B

The first port of call should be your emergency reserves, which is what they are designed for, to replace an income that typically covers 3 to 6 months. Once you have had time to review your overall finances, you should look at drawing from pots in the right order, mainly to minimise tax.

For those who are 55+, pensions and equity release may be suitable options. But just because these are available, you need to consider these carefully because there are multiple facets to consider.

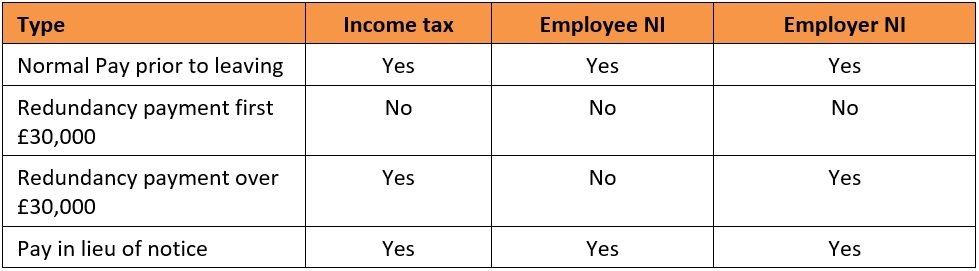

What is the tax treatment of redundancy pay?

This next section looks at how redundancy packages are taxed and the wider impact on other benefits and tax allowance. We’ll also look at the main tax planning strategy that can help maximise your wealth and minimise your tax.

The maximum statutory redundancy pay is £16,140. This is the minimum. Many firms offer enhanced terms to seek volunteers.

Here’s a summary of the different elements and how they are taxed:

Therefore, a redundancy package under £30k does not mean it is 100% tax free. Once you have this breakdown, you can analyse how best to plan around maximising your redundancy pay. The potential pitfalls include:

- Tax Rates – a large one-off payment could push you into the next tax bracket which subsequently affects the taxation of other form of income types.

- Personal Allowance – will the payment cause you to lose your personal allowance.

- Child benefits – will the payment cause you or your partner to lose your entitlement to child benefit.

- Annual allowance – will the redundancy payment affect your annual allowance.

A tax planning strategy could be to use part, or all, of your redundancy payments as an investment into a registered pension scheme. This will attract valuable tax relief.

It is worth noting that those who currently pay pension contributions before any tax is deducted, it is important to clarify if the redundancy package on offer is based on pre/post salary exchange.

Going through redundancy can be a difficult time for many people. But, equally, for some, it can be a blessing in disguise; a welcome cash injection that could mean retirement plans can be brought forward or savings boosted if they are able to secure other source(s) of income. With the right tax planning, those retirement and savings goals could be accelerated.

At Iron Wealth, we can help you navigate the next steps. We will maximise the efficiency of your sequencing. Whatever your financial objectives, we will help you get there quicker.

Risk Warnings:

The information contained in this article is intended solely for information purposes only and does not constitute advice. The price of investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested. Past performance is not necessarily a guide to future performance.

The Iron Wealth Blog